The Infiltration Reduction Act (IRA) residential energy tax credits and rebates is/was supposed to go into effect this year (2023). Where are we with it?

The incentives available to the average homeowner (and vehicle owner) are split between tax credits and rebate programs. The IRS has provided the regulatory framework on tax credits and the Department of Energy (DOE) will provide each state with rebate funding and guidance. California is currently waiting on the DOE’s guidance before they can implement the State’s rebate program and it should be available in 2024.

California Energy Commission

California Energy Commission is developing two programs: the Homeowner Managing Energy Savings (HOMES) rebate program and point-of-sale High-Efficiency Electric Home Rebate (HEEHRA) program.

The CEC expects rebates will become available in 2024. Until the DOE issues guidance to states, the CEC will not have California-specific information to share; however, the CEC is open to receiving written input through the docket.

Homeowner Managing Energy Savings (HOMES) Rebate Program

The HOMES program will provide performance-based rebates for whole-house energy saving retrofits. The amount of the rebate varies by the amount of energy savings. For eligible LMI (Low to Moderate Income) households, the rebate level is higher.

- About $292 million to be allocated for California.

- Performance-based rebates for whole-house energy efficiency upgrades for single-family homes and multifamily buildings.

- Up to $8,000 ($400,000 for a multifamily building) depending on energy savings and household income.

- Eligible applicants: homeowners or aggregators

High-Efficiency Electric Home Rebate (HEEHRA) Program

The HEEHRA program will provide point-of-sale rebates for qualified electrification projects in LMI households. Example projects include the purchase and installation of electric heat pumps and electric stoves certified by the Energy Star program.

- About $290 million to be allocated for California.

- Point-of-sale rebates for purchase and installation of qualified Energy Star appliances such as electric heat pumps for space heating and cooling. Includes rebates for panel upgrades, wiring, and insulation.

- Up to $14,000.

- Limited to households below 150% of area median income.

- Eligible applicants:

- Low- or moderate-income (LMI) households.

- Owners of eligible LMI multifamily buildings.

- Governmental, commercial, or nonprofit entity carrying out a project for an eligible household or an owner of an eligible multifamily building.

Timelines for the California IRA (Inflation Reduction Act) Residential Energy Rebate Programs

2022 (December): U.S. DOE issued a Request for Information for Contractor Training

2023 (January): U.S. DOE issued a Request for Information for HOMES and HEEHRA

2023 (Q1/Q2/Q3): CEC workshops & program development

2023 (Spring): Guidance and funding available to States and Tribes for Contractor Training

2023 (Summer): Guidance and funding available to States and Tribes for Rebates

2024: Programs launched; rebates available to the public

Federal Tax Credits

The IRA legislation established tax credits for electric vehicles and residential energy improvements. Many of these are available for 2022 but are limited.

Let’s say you want to improve the energy efficiency of your home and you think changing out the windows will help (for most places in California this is NOT a cost-effective energy upgrade). The tax credit in 2022 is 10% of the cost, so a $10,000 window upgrade will get you 1,000 in tax credits (unless you have used this before in the past few years up to a maximum of credit limit) and if you have you will get nothing.

Starting in 2023 your window retrofit will get you a 30% tax credit up to $600. A $10,000 window upgrade would get you $3,000 at the 30% but it is limited to only $600 or 6%. There is a work around for some of these projects as there is a tax credit cap of $1,200 per year so don’t upgrade all your windows in the same year. Install $1,800 worth of windows (approximately the cost of 2 windows) each year until your house is retrofitted. That way you will get a $600 tax credit each year for the windows.

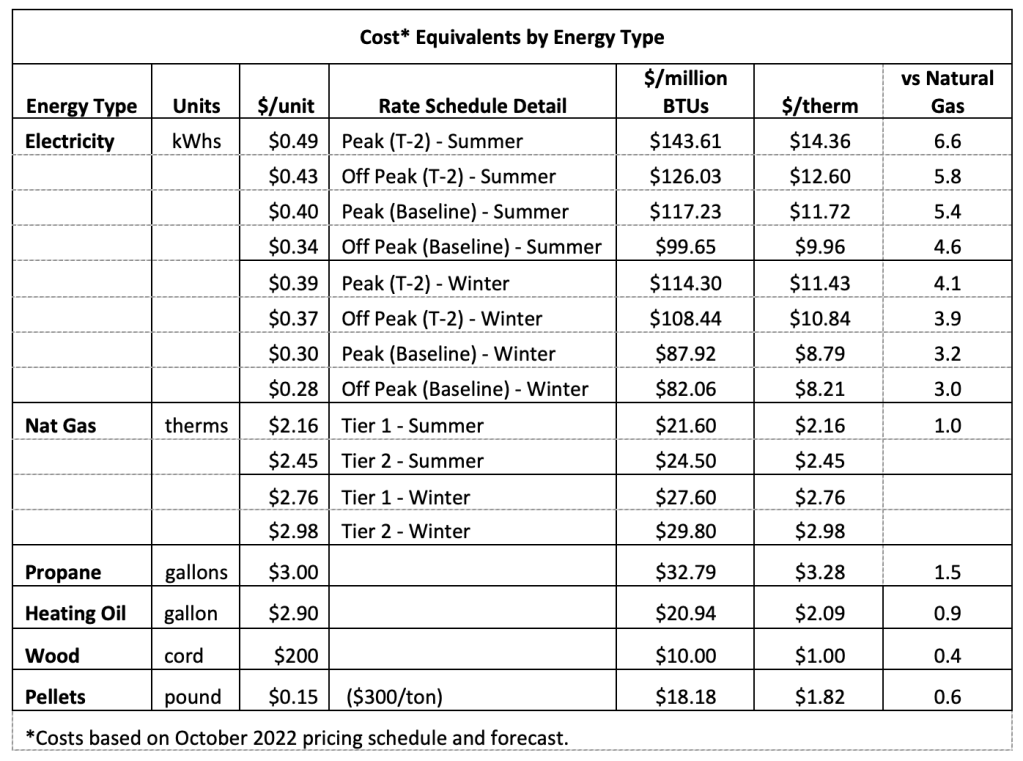

Other tax credits include 30% for heat pumps, heat pump water heaters, and biomass stoves up to $2,000 per year. See the list below for the complete list. You might want to wait on a heat pump water heater because there is supposed to be a rebate available for them up to $2,500. You will probably notice the prices of all these tax creditable and rebatable items will go up once the incentives go into effect as retails tax advantage of consumers getting the rebates and tax credits.

Electric Vehicles

If you buy a new plug-in electric vehicle (EV) or fuel cell vehicle (FCV) in 2023 or after, you may qualify for a clean vehicle tax credit.

Who Qualifies

- You may qualify for a credit up to $7,500 under Internal Revenue Code Section 30D if you buy a new, qualified plug-in EV or fuel cell electric vehicle (FCV). The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032.

- The credit is available to individuals and their businesses.

- To qualify, you must:

- Buy it for your own use, not for resale

- Use it primarily in the U.S.

- In addition, your modified adjusted gross income (AGI) may not exceed:

$300,000 for married couples filing jointly

$225,000 for heads of households

$150,000 for all other filers

The credit is nonrefundable, so you can’t get back more on the credit than you owe in taxes. You can’t apply any excess credit to future tax years.

Qualified Vehicles

To qualify, a vehicle must:

- Have a battery capacity of at least 7 kilowatt hours

- Have a gross vehicle weight rating of less than 14,000 pounds

- Be made by a qualified manufacturer.

- FCVs do not need to be made by a qualified manufacturer to be eligible.

- Undergo final assembly in North America

The sale qualifies only if:

- You buy the vehicle new

- The seller reports required information to you at the time of sale and to the IRS.

- Sellers are required to report your name and taxpayer identification number to the IRS for you to be eligible to claim the credit.

- In addition, the vehicle’s manufacturer suggested retail price (MSRP) can’t exceed:

$80,000 for vans, sport utility vehicles and pickup trucks

$55,000 for other vehicles

How to Claim the Credit

To claim the credit, file IRS Form 8936 with your tax return